How a registered trade mark can grow your sales and your business

.

Your brand is often the first thing your customers see when interacting with your business, and by registering a trade mark for it, you have peace of mind that your brand is legally protected.

In addition, a business with a registered trade mark is 13% more likely to achieve high turnover growth, according to a study by IP Australia.

Despite the positive data, less than 4% of Australian small businesses have a registered trade mark.

What is a trade mark?

A registered trade mark legally protects your business’s unique brand, products or services, and helps customers distinguish your products or services in the market.

Those without a registered trade mark may be missing out on these potential benefits:

- after filing for an intellectual property (IP) right, such as a registered trade mark, small to medium enterprises (SMEs) are 16% more likely to experience high employment growth compared to businesses with no recent IP filings, according to research by IP Australia

- for businesses launching products, each additional registered trade mark is linked to an 8% revenue increase per employee

- applying for a trade mark is linked to an increase in start-up valuation

- SMEs that own IP rights on average employ 3.5 times as many people as their peers with no IP rights and pay a higher median wage.

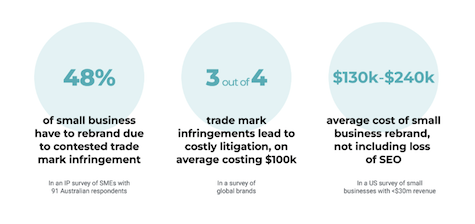

But what about the businesses that don’t check their branding? Checking the availability of your brand name or logo can be important to avoid infringing a competitor’s registered trade mark. By not checking, businesses can run the risk of needing to rebrand and may face litigation, and the associated costs. Check out the numbers below.

Case study – Fat Duck vs Heston Blumenthal

The Fat Duck restaurant opened in Sydney in 2011. Shortly after opening, the restaurant was required to relinquish their name and rebrand.

This rebranding was a result of celebrity chef Heston Blumenthal filing an application for trade mark protection. Intending to reserve and protect the name for his chain of fine dining restaurants, Heston’s company filed a claim in the Federal Court of Australia and won, having filed all the requirements for the trade mark rights.

The Fat Duck restaurant was required to rebrand their business, demonstrating that if you haven’t protected your name or logo against competitors, you may run the risk of losing the rights to it.

Case Study – SEO Shark

SEO Shark is a digital marketing agency that specialises in search engine optimisation (SEO).

In conversation with IP Australia, SEO Shark® explained that “as competition grew, we knew in order to protect and differentiate the brand from other businesses we needed to trade mark the name. The SEO Shark trade mark is our identity, the way we show who we are to customers and this is something we don’t want another business to replicate. We now have the name and logo of SEO Shark registered, meaning we can prevent other businesses in Australia using our trade marks.”

Their advice for other businesses looking to protect their brand is to understand the time and costs involved in applying for a trade mark. They may not be as much as you think! The cost of a trade mark is often assumed to be beyond the budget of a small business, but in total, the cost of protecting SEO Shark® was about $600 for ten years’ protection.

Case study – Tutu by You

Tutu by You was launched in 2020 by business partners and cousins, Steph Young and Emily Murray. They wanted to create a brand for kids, and something that would bring much joy and happiness to the world. Their strategy for IP protection was to protect what they could, with an emphasis on making sure they used the right type of protection.

Emily told IP Australia, “Protecting our IP is so important because it’s everything, right? We’ve worked so hard on this. We’ve only launched six months ago, but we’ve been working on this for two and a half years. There were moments where we thought, ‘Do we really need to spend that money to get that protected? Is anyone going to care about us? Are they really going to try and rip us off?’ You just don’t know. It’s a risk. You’ve got to take it.”

Tutu by You wanted to protect their business name using a trade mark, and their unique ‘sparkle band’ using a design right. They now feel confident in taking their products to market across all platforms because of their IP protection.

To read the full case study visit IP Australia’s website.

How can you check and register a trade mark?

The new, free pilot TM Checker tool makes it easier for small businesses to check if a trade mark is available. An initial check only takes a few minutes, then you can apply to register for a trade mark using the tool for as little as $330.

Registering your trade mark gives you:

- a business asset: the more successful your business becomes, the more valuable your trade mark becomes.

- the legal right to place the ® symbol next to your trade mark

- exclusive rights to use your trade mark in Australia

- the ability to legally deter others from using your trade mark

- the ability to sell your trade mark, or license it for others to use.

Small business owner Deborah had this to say about TM Checker:

Remember that a registered trade mark can be used to protect anything that identifies your business such as a brand name, logo, distinctive phrase, letter, number, colour, sound, smell, shape, picture, movement, aspect of packaging or a combination of these.